change in net working capital as a percentage of change in sales

In-depth Explanation of Working Capital. In general the higher the number the more financial risk is involved in.

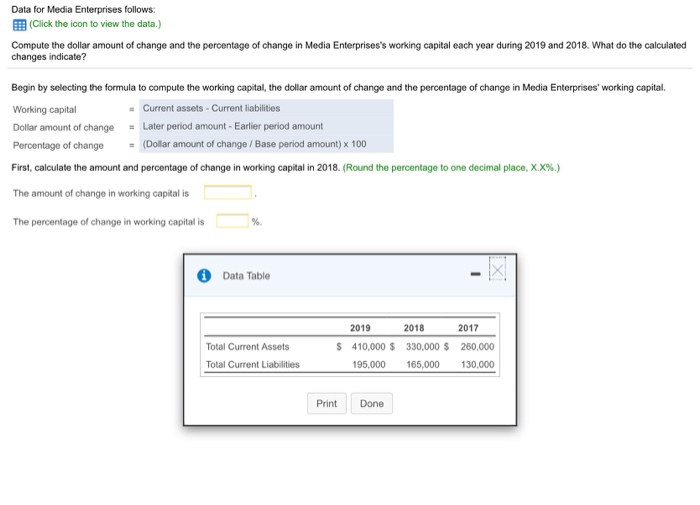

Solved Data For Media Enterprises Follows Eb Click The Icon Chegg Com

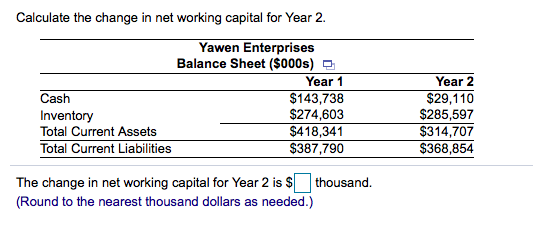

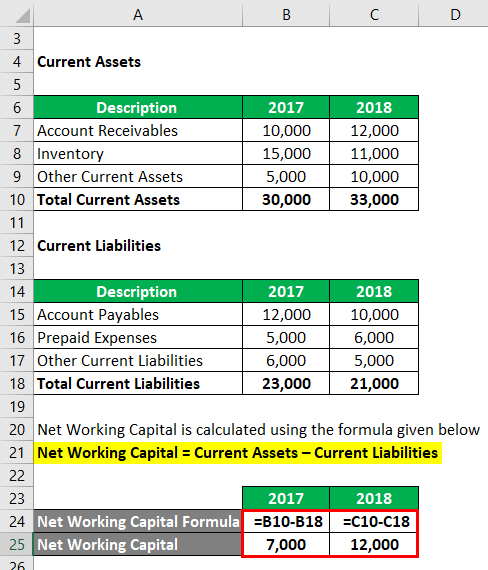

The last step is to find the change in net working capital.

. Subtract the previous years working capital from the current years working capital according. For instance if a companys current liabilities. The change in working capital formula is straightforward once you know your balance sheet.

The NWC relative to sales varies by industry as net working capital can represent 2 of sales or even 20 of sales. So a positive change in net working capital is cash outflow. This means that for a company with positive net working capital NWC.

For the year 2019 the net working capital was 7000 15000 Less 8000. In this example the change in working capital in. Simply take current assets and subtract current liabilities.

Plus as revenues rise or fall net working capital tends to stay constant as a percentage of sales. Working capital as a percent of sales is calculated by dividing working capital by sales. You just need to minus the current years working capital from last years.

Given those figures we can calculate the net working capital NWC for Year 0 as 15mm. Current Operating Assets 50mm AR 25mm Inventory 75mm. If a business requires a lot of current assets to generate sales.

The sales to working capital ratio is calculated by dividing annualized net sales by average working capital. The last step is to determine the change in working capital by using the formula. To calculate net sales subtract returns 400 from gross sales 25400.

The formula is working capital divided by gross sales times 100 For example if working capital amounts to 140000 and gross sales are 950000 working capital as a. Hence there is obviously an assumption that working. For year 2020 the net working capital is 10000 20000 Less 10000.

You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow. You can express the ratio as a percent that tells you what percentage of net. Annualized net sales Accounts receivable.

Now lets break it down and identify the values of different variables in the problem. Accrued Expenses 20mm. The working capital to sales ratio uses the working capital and sales figures from the previous years financial statements.

Now changes in net working.

Days Working Capital Definition Formula Calculation

Pdf Working Capital Management And Financial Performance Of Uk Listed Firms A Contingency Approach Semantic Scholar

Net Working Capital The Industrial Oem S Challenge Article Kearney

Net Working Capital Formula What It Is How To Calculate It And Examples Planergy Software

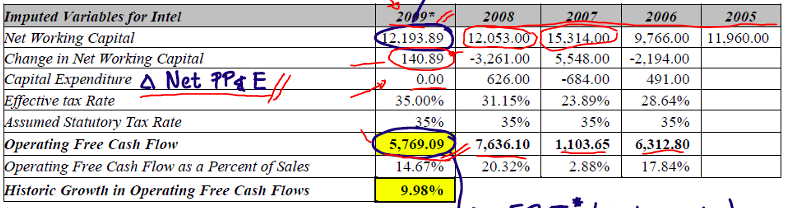

How Was The Operating Free Cash Flow As A Percentage Chegg Com

Change In Net Working Capital Formula Calculator Excel Template

Net Working Capital Formulas Examples And How To Improve It

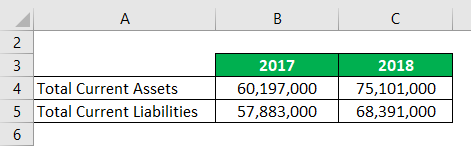

Solved Calculate The Change In Net Working Capital For Year Chegg Com

Calculate The Change In Working Capital And Free Cash Flow

What Is Net Working Capital How To Calculate Nwc Formula

Normal Level Of Net Working Capital At Closing Divestopia

Working Capital Management Estimation And Calculation

Working Capital Formula Components And Limitations

How To Calculate Working Capital Turnover Ratio Flow Capital

Change In Net Working Capital Formula Calculator Excel Template

Change In Net Working Capital From A Metric To The Valuation Of A Firm

Privatization Statement Sc 13e3

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations

Net Working Capital Formula What It Is How To Calculate It And Examples Planergy Software